All Categories

Featured

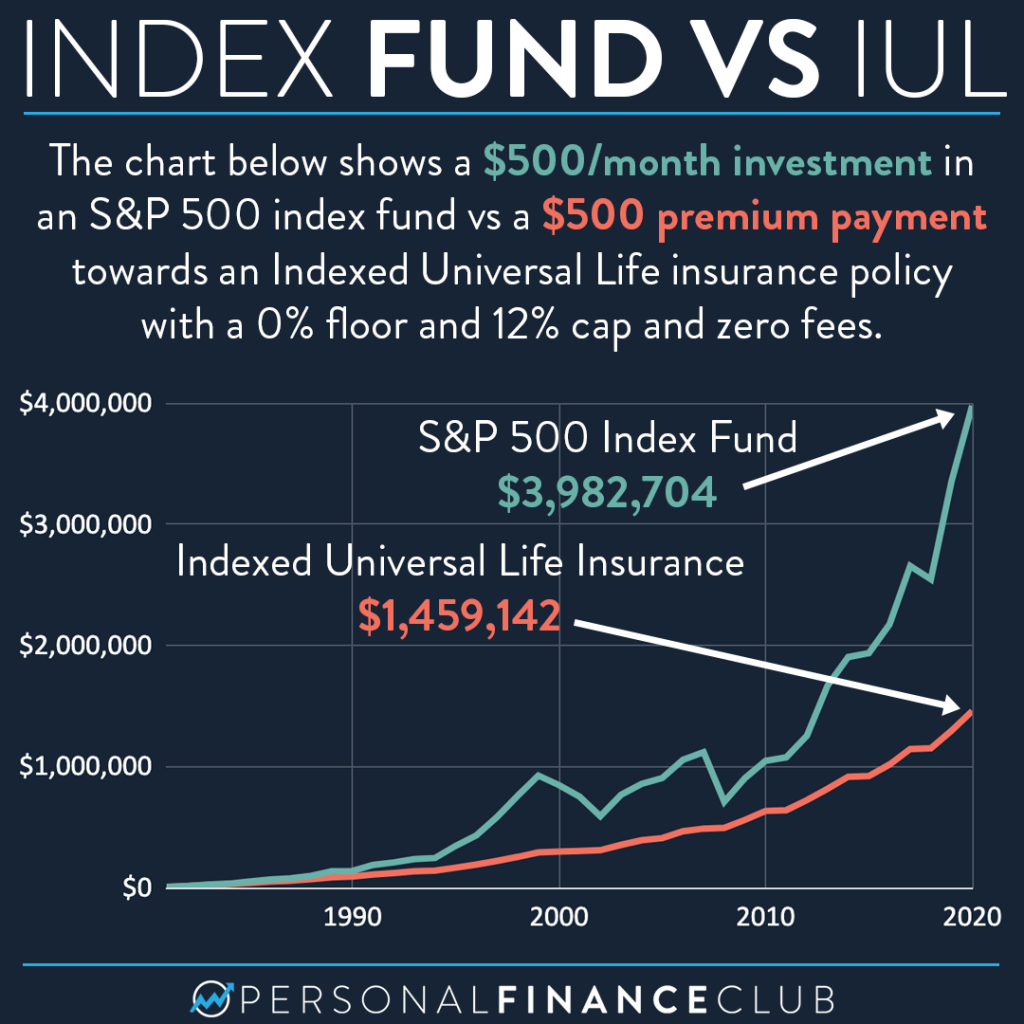

If you're mosting likely to use a small-cap index like the Russell 2000, you might desire to stop and think about why a great index fund business, like Vanguard, doesn't have any funds that follow it. The reason is because it's a lousy index. In addition to that altering your whole plan from one index to another is hardly what I would call "rebalancing - aig index universal life insurance." Cash value life insurance policy isn't an appealing asset class.

I haven't also dealt with the straw guy here yet, and that is the truth that it is fairly unusual that you actually have to pay either tax obligations or significant payments to rebalance anyhow. A lot of smart financiers rebalance as much as feasible in their tax-protected accounts.

Life Insurance Surrender Cost Index

Decumulators can do it by withdrawing from possession classes that have actually succeeded. And naturally, nobody ought to be getting loaded shared funds, ever before. Well, I really hope blog posts like these help you to translucent the sales strategies usually utilized by "economic specialists." It's truly too negative that IULs don't work.

Latest Posts

Indexed Universal Life Insurance Good Or Bad

Universal Life Insurance Providers

Group Universal Life